At NEWITY, we’ve made an easier solution to entry business funding for small businesses. In the final 3 many years, we’ve assisted businesses entry $11.four billion in cash by means of SBA loans and tax credits. Now, it’s your transform.

Kiah Treece can be a certified lawyer and small business owner with working experience in real estate and financing. Her emphasis is on demystifying financial debt that will help folks and business proprietors acquire control of their funds.

Business bank cards can be quite a superior financing selection for business people if they need to have money in a short time frame, Have got a record of ample income, and possess a superb personalized and/or business credit score scores. Specific business bank cards may even enable Construct business credit.

Residence values are continuously transforming based upon buyer desire along with the neighborhood sector. Commonly, house values improve over time. Contact a Nevada lender to learn more about neighborhood necessities for mortgages.

Considered one of the main advantages of the SBA 504 program was its need for just ten % down payment, Tucker said. “It absolutely was easier to come up with that funds becoming a small business operator and entrepreneur,” she explained. “To come up with any more than that would happen to be a struggle.”

Don't forget, a loan is actually a binding arrangement for just a given timeframe, and when you finally signal the documentation, you’re devoted to shelling out the a refund according to the agreed-upon terms. Be sure to know exactly what you’re moving into ahead of the loan is finalized.

Usually, you must have a decent credit score score and the chance to show which you’re jogging your business in accordance with the necessities of that loan. You may see Higher Nevada Credit rating Union’s loan application prerequisite checklist listed here.

Business loans are typically repaid in monthly installments about a set stretch of time, for example numerous months or many years. They could feature set curiosity rates or service fees, which keep on being constant in excess of the life span with the loan, or variable curiosity rates, which can fluctuate.

Zillow Group is devoted to ensuring electronic accessibility for people with disabilities. We are continuously Operating to Increase the accessibility of our Website practical experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek out an accommodation, you should let us know.

Devices loans are granted specifically for the acquisition of new gear, making use of what you purchase as collateral.

During this guideline, find out more with regards to the pluses and minuses of business loans and contours of credit and the way to select the appropriate option for your funding ambitions.

Invoice factoring in Nevada has aided grow the logistic and producing business. The logistic marketplace has lengthy payment cycles, in some cases assuming that thirty-90 days. This enables businesses to acquire payment the moment they Bill shoppers, get more info providing providers the Operating funds to take on the following task.

Get the flexibility you have to make the most of business opportunities. Use this business line of credit history to fund seasonal alterations in inventory and receivables, take advantage of seller reductions or meet unpredicted cash desires.

Yes, American Express obtains reports from consumer reporting organizations. American Convey will likely report your funding account payment standing to buyer credit score reporting agencies in accordance Using the loan settlement.

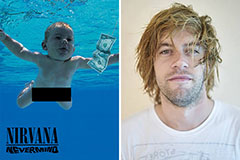

Spencer Elden Then & Now!

Spencer Elden Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!